Equity-Go Trend Sees Surge in Strength as Financials Drive Price Higher

As the global economy continues to recover from the impact of the Covid-19 pandemic, one investment trend that has been gaining strength is the Equity-Go trend. This trend, characterized by a surge in equity prices driven by strong performance in the financial sector, has been capturing the attention of investors and analysts alike.

Financials have been at the forefront of driving the Equity-Go trend higher, with major banks and financial institutions reporting robust earnings and strong balance sheets. This has boosted investor confidence in the sector, leading to increased allocations to financial stocks and related investments.

One of the key factors driving the strength of the Equity-Go trend is the improving economic outlook globally. As countries continue to roll out vaccination programs and gradually reopen their economies, there is growing optimism about a swift recovery in economic growth. This positive sentiment has translated into higher stock prices across sectors, with financials leading the way.

Another driver of the Equity-Go trend is the low-interest-rate environment that has persisted since the onset of the pandemic. Central banks around the world have maintained accommodative monetary policies to support economic recovery, keeping interest rates at historically low levels. This has made equities an attractive investment option for investors seeking higher returns than traditional fixed-income securities.

In addition to financials, technology stocks have also played a significant role in driving the Equity-Go trend higher. The rapid digital transformation spurred by the pandemic has fueled strong performance in the technology sector, with companies benefiting from increased demand for online services and solutions.

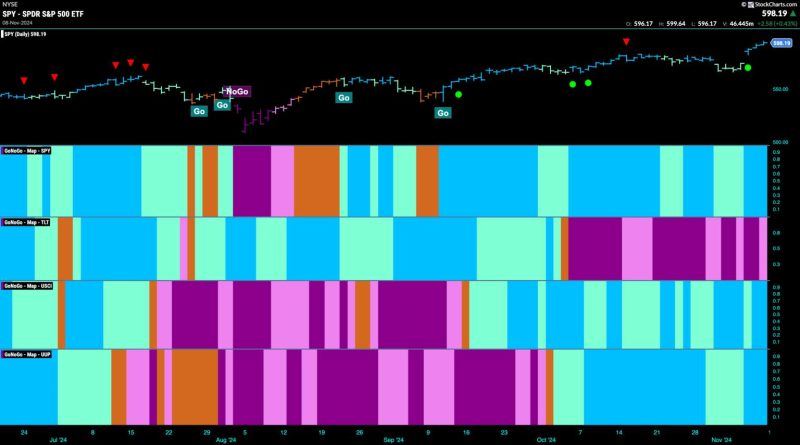

The surge in strength of the Equity-Go trend has not gone unnoticed by investors, who are increasingly looking to capitalize on the momentum in the market. Exchange-traded funds (ETFs) focused on financials and technology have seen strong inflows, as investors seek exposure to sectors driving the Equity-Go trend.

Looking ahead, the sustainability of the Equity-Go trend will depend on continued strength in the financial and technology sectors, as well as favorable macroeconomic conditions. While risks such as inflation and geopolitical tensions loom on the horizon, the positive momentum in equities driven by the Equity-Go trend is expected to persist in the near term.

In conclusion, the Equity-Go trend has seen a surge in strength as financials and technology stocks continue to drive prices higher. With improving economic conditions and supportive monetary policies, investors are optimistic about the prospects of the Equity-Go trend in the months ahead.