In recent times, the Nifty has experienced a sluggish trend, navigating through various resistances that have impeded its upward momentum. As market participants keenly watch the unfolding dynamics, the weeks ahead are fraught with challenges and opportunities alike. It is crucial for investors to gain a comprehensive understanding of the multiple resistances that are currently influencing market movements in order to strategize effectively and make informed decisions.

The Nifty’s trajectory is being influenced by a confluence of factors, making it imperative for investors to adopt a cautious stance. The upcoming week is likely to be characterized by continued sluggishness, as the Nifty grapples with resistances that are firmly entrenched within a specific zone. These resistances are serving as key hurdles, inhibiting the index’s ability to surge ahead with conviction.

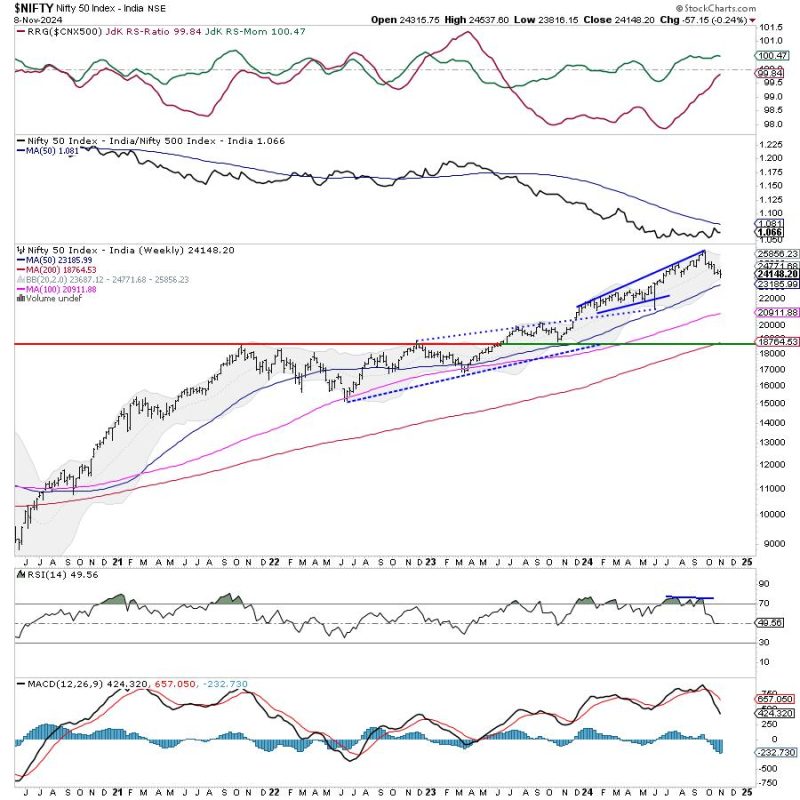

Several technical indicators suggest that the Nifty is poised to face formidable resistances in the near future. From moving averages to Fibonacci retracement levels, multiple signals point towards a challenging path forward for the index. Market participants would do well to pay close attention to these indicators and factor them into their decision-making processes.

One of the crucial aspects that investors need to consider is the significance of these resistances in the broader market context. The clustering of resistances within a specific zone underscores the importance of this price level as a critical juncture for the Nifty. Traders and investors would benefit from closely monitoring how the index reacts around these levels, as it could provide valuable insights into the market’s sentiment and potential future direction.

In light of these observations, market participants are advised to tread cautiously and adopt a prudent approach to navigate the current market environment. While challenges loom large, opportunities abound for those who remain nimble and astute in their decision-making. By being vigilant, proactive, and well-informed, investors can position themselves to capitalize on the shifting dynamics of the market and steer their portfolios towards success in the weeks ahead.

In conclusion, the Nifty’s journey ahead is likely to be characterized by sluggishness and multiple resistances that present significant obstacles for the index. By closely monitoring key technical indicators and remaining attuned to market developments, investors can navigate these challenges with confidence and poise. The coming weeks will test the resilience and acumen of market participants, offering them the opportunity to demonstrate their understanding of market dynamics and capitalize on emerging opportunities in a rapidly evolving landscape.