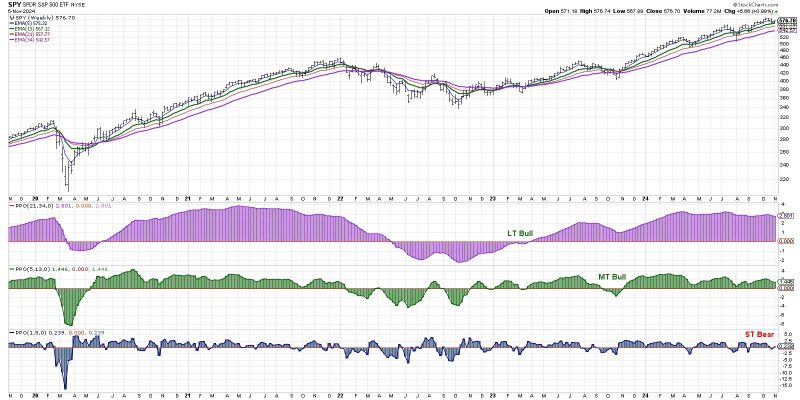

The article available at the provided link discusses a short-term bearish signal in the markets as they prepare for a news-heavy week. The analysis delves into various factors influencing market sentiment, including upcoming economic data releases, geopolitical tensions, and economic indicators.

The article evaluates how market participants are navigating through volatile conditions amid uncertainties surrounding global events. It highlights the importance of investor caution and risk management strategies in such times to mitigate potential losses.

Moreover, the article provides insights into how different asset classes may be affected by the current market conditions. It discusses the potential impact on stocks, bonds, commodities, and currencies, shedding light on the interconnected nature of financial markets.

Additionally, the article emphasizes the significance of staying informed and abreast of market developments to make well-informed investment decisions. It underlines the role of comprehensive research, expert analysis, and monitoring market trends for traders and investors alike.

Overall, the article serves as a thought-provoking piece that prompts readers to consider the implications of short-term bearish signals and the importance of a cautious approach in navigating through dynamic market environments. It encourages a proactive stance towards risk management and staying informed to adapt to changing market conditions effectively.