In the realm of financial markets, the recent movements in Nifty have been closely watched and analyzed by traders and analysts alike. The violation of key support levels has sent ripples across the market, leading to a chain reaction that has impacted various aspects of trading.

At the heart of the matter lies the crucial aspect of support and resistance levels. These levels act as vital markers in determining the overall trend and sentiment of a particular asset or index. In the case of Nifty, the breach of key support levels has not only altered the immediate trajectory but has also had broader implications on the market dynamics.

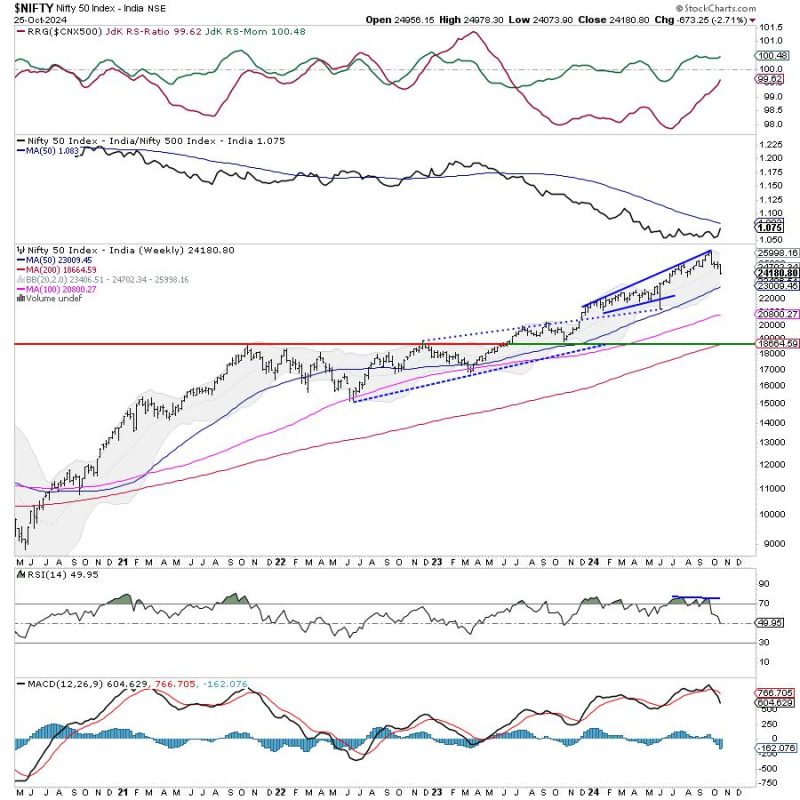

The cascading effect of the violation of support levels is evident in the downward pressure exerted on resistance levels. As Nifty continues to struggle to regain its footing, the resistance levels have been pushed lower, making it harder for the index to make significant upward moves. This dynamic shift in the support-resistance interplay has created a challenging environment for traders and investors, forcing them to adapt their strategies accordingly.

Moreover, the breach of support levels has brought to the fore the underlying weaknesses in the market. The inability of Nifty to sustain above key support levels points towards a lack of strong bullish momentum, raising concerns about the sustainability of any potential rally. This has put a spotlight on the need for caution and risk management in navigating the uncertain waters of the current market scenario.

In addition to the technical implications, the violation of support levels has also had broader implications on market sentiment and investor confidence. The sudden shift in the market dynamics has created a sense of unease among market participants, leading to increased volatility and uncertainty. This, in turn, has made it imperative for traders to exercise caution and prudence in their decision-making processes.

Moving forward, the coming days are likely to be crucial in determining the trajectory of Nifty and the broader market. The ability of Nifty to find strong support and overcome the resistance levels will be a key factor in instilling confidence among investors and signaling a potential reversal in the current downtrend. However, should Nifty fail to reclaim lost ground and break above resistance levels, the downward pressure could persist, further denting market sentiment.

In conclusion, the recent violation of key support levels in Nifty has set off a chain reaction that has impacted various facets of the market. The shifting dynamics between support and resistance levels have created a challenging environment for traders, highlighting the importance of adaptability and risk management. As the market navigates through these turbulent waters, vigilance and a cautious approach will be paramount in capitalizing on potential opportunities while safeguarding against inherent risks.