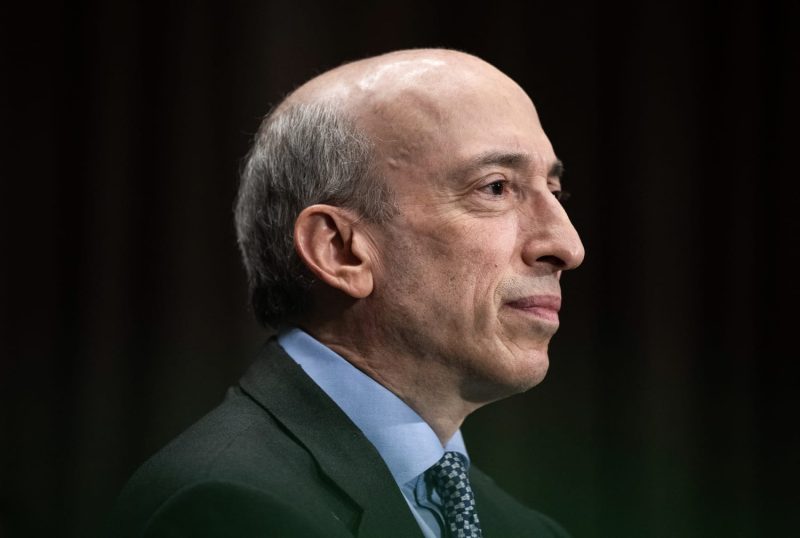

SEC Chair Gary Gensler Will Step Down Jan. 20, Making Way for Trump Replacement

According to recent reports, U.S. Securities and Exchange Commission Chairman Gary Gensler will be stepping down from his position on January 20. This development has sparked speculations about who will be appointed as his successor, with some suggesting that a replacement nominated by former President Donald Trump could take over the role. Gensler’s impending departure marks the end of his relatively short tenure at the SEC, during which he has made significant strides in regulatory reforms and enforcement actions.

Since assuming the role of SEC Chair in April 2021, Gary Gensler has been at the forefront of efforts to enhance oversight and accountability in the financial markets. His tenure has been characterized by a focus on investor protection, market transparency, and the regulation of emerging trends such as cryptocurrency and digital assets. Gensler’s proactive approach to addressing regulatory gaps and promoting fair practices has garnered both praise and criticism from various stakeholders.

During his time as SEC Chair, Gary Gensler has spearheaded several key initiatives aimed at strengthening investor safeguards and promoting market integrity. Notable among these efforts is the SEC’s push for greater disclosure requirements for companies, particularly in relation to climate-related risks and human capital management. Gensler has also been a vocal advocate for increased regulatory oversight of digital assets and cryptocurrencies, emphasizing the need for robust investor protection measures in these rapidly evolving markets.

In addition to his regulatory reform agenda, Gary Gensler has been actively involved in enforcement actions against entities engaged in fraudulent or deceptive practices. Under his leadership, the SEC has taken action against numerous companies and individuals for violations of securities laws, signaling a commitment to upholding market integrity and holding wrongdoers accountable. Gensler’s tenure has been marked by a proactive enforcement approach that aims to deter misconduct and protect investors from financial harm.

As news of Gary Gensler’s impending departure spreads, attention has turned to the potential implications of his replacement by a nominee chosen by former President Donald Trump. Speculations abound regarding the direction that the SEC may take under new leadership, with some anticipating a shift towards a more business-friendly regulatory stance. The appointment of a Trump-nominated successor could signal a departure from the progressive regulatory agenda championed by Gensler, raising concerns among consumer advocates and investor protection groups.

In conclusion, Gary Gensler’s upcoming departure as SEC Chair on January 20 marks the end of an era characterized by robust regulatory reforms and enforcement actions. His tenure has been defined by a strong emphasis on investor protection, market transparency, and regulatory oversight of emerging trends in the financial markets. As the search for his replacement begins and speculations swirl about the potential impact of a Trump-appointed successor, the future direction of the SEC hangs in the balance. Only time will tell how Gensler’s legacy will shape the regulatory landscape and investor protection efforts in the years to come.